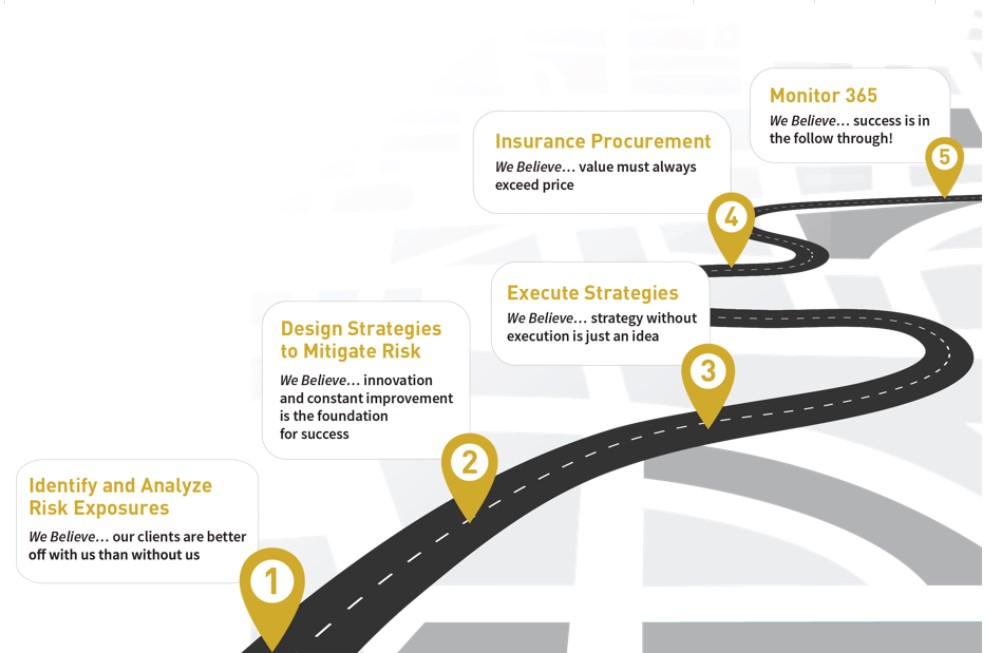

Process

Kingsgate Insurance prides ourselves on building relationships with those we work with to help you navigate the path to success. Our process really begins with the curiosity and desire to understand the inner workings of a business, otherwise it is not possible to adequately perform exposure identification.

We first will work with you to identify and analyze risk exposures which will then lead us to designing strategies to help mitigate risk. We believe innovation and constant improvement is the foundation for success. From there the strategies will be executed with procurement of insurance where we believe that value must always exceed the price. We close our process with monitoring as success is in the follow through!

Our approach really helps to set us apart from other insurance agencies and there are multiple benefits…

- In depth understanding of your operations

- Increased comfort with your risk

- Creates competition in the insurance marketplace

- More willing to make exceptions and be creative

- Offer most favorable terms and lowest possible price

Let us review your current risk management program and we’ll pair your business with the right solution at the right price.

Commercial Property

When evaluating insurance protection for your assets (i.e. Buildings, Personal Property, Income, Equipment, Stock, etc.), the process must begin with a conversation around goals and expectations should there be a loss.

Will you stay at that location?

Do you intend to rebuild if your building was lost?

If you do, what, if anything would you do differently?

In addition, it’s important to work through the GuideTrak process to identify areas of exposure unique to your specific assets. For example, if you’re a contractor, maybe you have a revolving door of materials running through your facility that are ultimately destined for jobsites, how should that be handled. Just as you would expect a physician to ask questions when examining your illness, a competent insurance professional should do the same, diagnosing your specific needs.

General Liability

It is important to understand that general liability helps to cover costs that result from claims against your business. As it excludes damage to your business property (these types of claims are covered by commercial property insurance), mistakes made in your business’s professional services (these types of claims are covered by professional liability insurance) and work-related injuries or illnesses (these types of claims are covered by a workers’ compensation insurance policy).