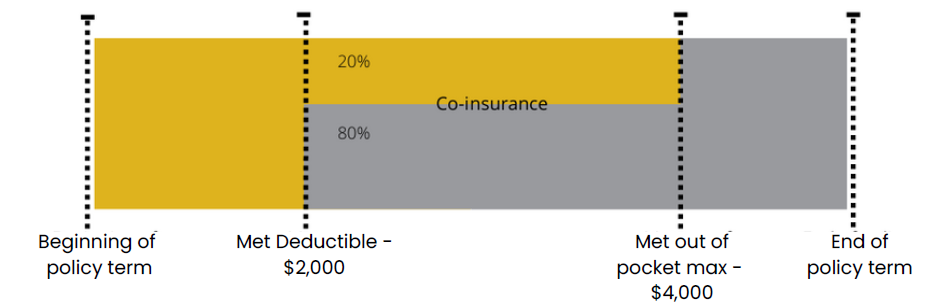

How does the Deductible, Coinsurance & Out of Pocket Maximum work?

The deductible is the amount an individual must pay out of their pocket before Insurance will share the

cost. The coinsurance is a percentage of total charges that YOU and the insurance company pay for

covered services after the deductible is met. The out of pocket maximum (OOPM) is anything spent out

on your own pocket (not premium) and it is the most that an individual or family will spend out of their

own pocket in 1 calendar year (or plan year).

Scenario – John Doe’s health insurance plan has a deductible of $2,000, 20% coinsurance & $4,000 out of

pocket maximum (OOPM). He breaks his leg and need a cast and physical therapy. Total charges after

any network savings is $6,000. He will pay the deductible right away – $2,000. John and the insurance

company will split the remaining balance (coinsurance)- 20/80. His 20% is $800, bringing the total out of

pocket to $2,800. John’s Physical Therapy appointments will be split 20/80 until the total out of pocket hits

$4,000. If/When the OOPM is met, all covered charges will be covered by the plan.

**deductible & out of pocket maximum totals grow together. **

Leave a Reply

Want to join the discussion?Feel free to contribute!